$14.5 Billion To Be Distributed

Are you one of them?

Dear inspired hustlers,

FTX CREDITORS HAVE HOPE?

544 Days Later...

For 544 days, creditors have been holding their breath, waiting for a glimmer of hope. Well, yesterday, they finally got it – FTX creditors are poised to reclaim 118% of their funds.

Here are the details:

98% of creditors will pocket up to 118% of their allowed claims.

The remaining 2%? Fully reimbursed PLUS awarded “billions in compensation.”

Pending approval and finalization by Delaware courts.

Only creditors with approved claims under $50,000 will qualify for the 118% offer.

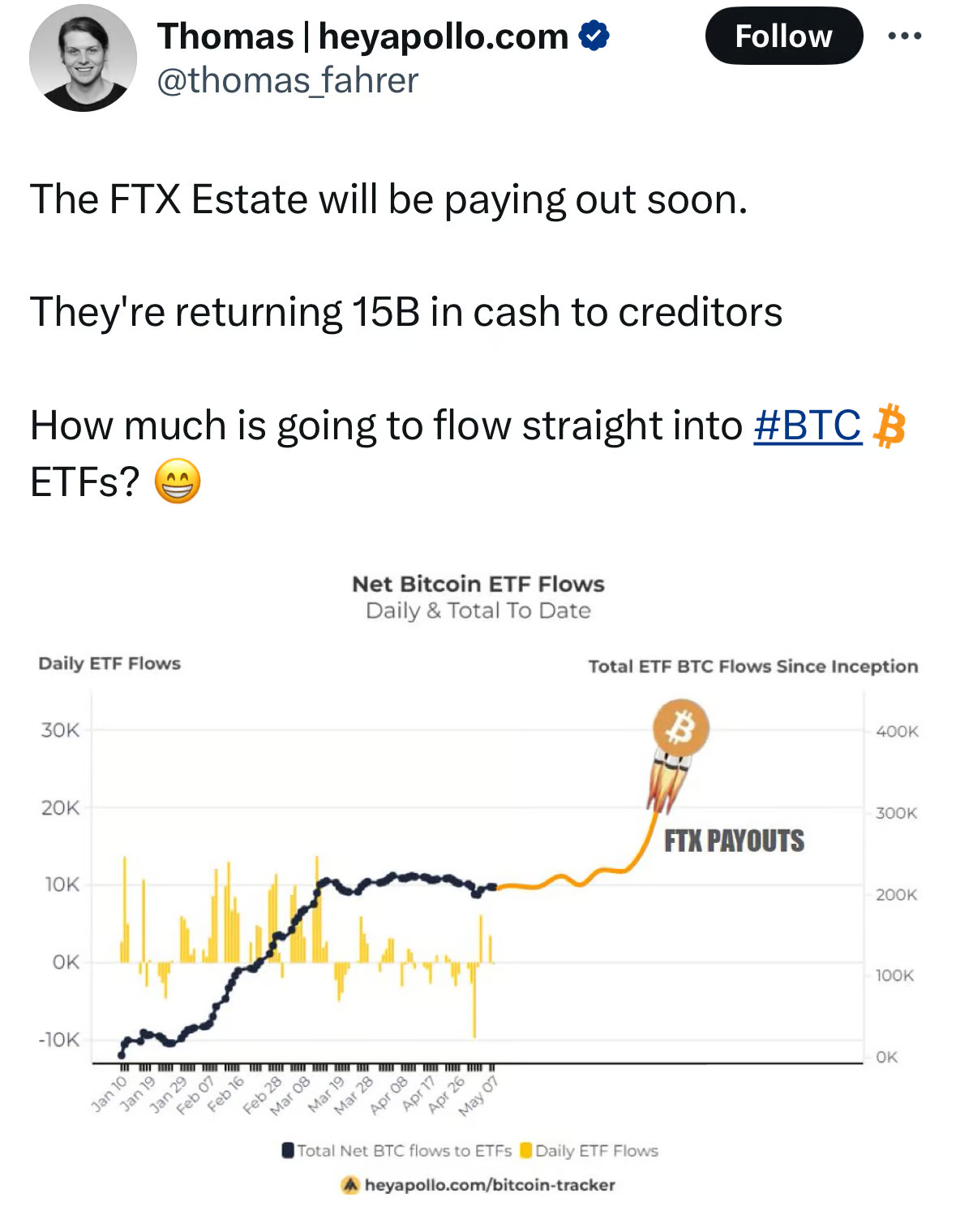

FTX anticipates distributing between $14.5 billion and $16.3 billion to creditors. (Remember, they were only $8B short at bankruptcy… leverage, huh?)

About 6% ($884M) of the payback came from a March sale of anthropic shares (they should’ve sold those shares back in Nov. ‘22…)

Did you catch wind of those rumors about creditors potentially getting refunds based on current market prices, overturning the original November '22 price plans?

Looks like those whispers might not materialize. Keep an eye out though – this saga is far from over.

AND everyone's speculating about where that ~$15B payout will end up next 👀

WEEKLY CRYPTO FUND FLOWS REPORT 📊

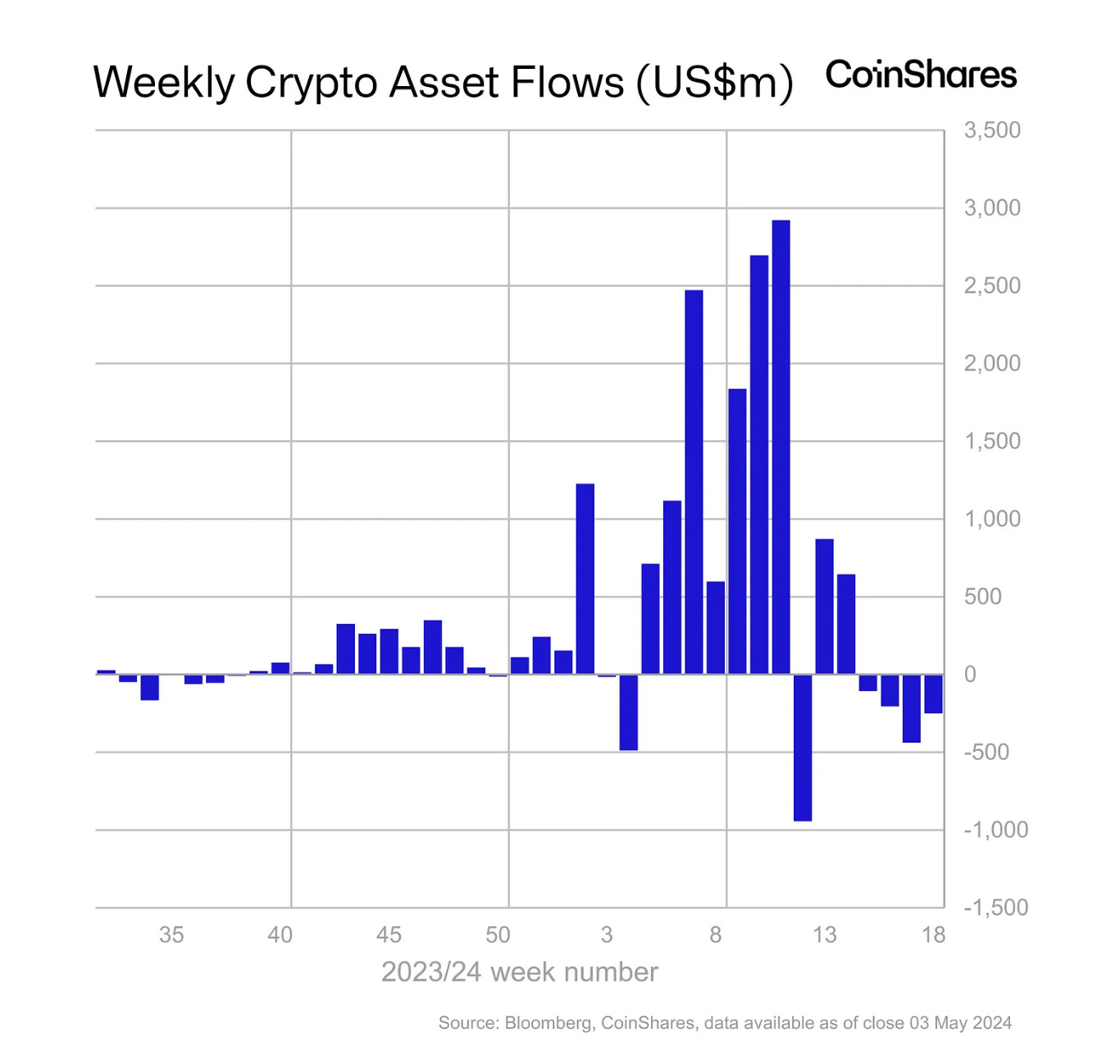

The digital asset investment products witnessed $251M in net total outflows last week.

That marks the 4th consecutive week of sell-offs.

Source: CoinShares

Here’s a breakdown of the report:

BTC led the way with $284M in outflows, an unusual occurrence as BTC was the only asset to see outflows.

ETH finally saw positive flows! After 7 straight weeks of outflows, ETH saw $30M in inflows last week.

The silver lining? Hong Kong’s new ETFs attracted $307M in total inflows during their debut week.

Several altcoins experienced inflows, with Avalanche, Cardano, and Polkadot emerging as the biggest winners.

As we head into the new week, we’ll be watching closely to see who can sustain their momentum.

Comparing absolute values of inflows and outflows may not tell the whole story. Instead, analyzing the flows as a percentage of total market cap is crucial.

For instance, $284M represents roughly 2% of the total net value of BTC ETFs, which is about $12B. When compared to the total BTC market cap of $1.23T, it appears almost negligible.

Episode 20: Breaking Stereotypes!

In our latest episode, we delve into the realm of Pakistani women who are carving out substantial profits in the cryptocurrency market. Join us as we uncover their winning strategies, glean insights from their setbacks, and witness how they're shattering stereotypes in the financial landscape.

We decode their successful tactics, dissect the lessons derived from their challenges, and witness firsthand how they're reshaping the financial narrative in Pakistan.

So, gear up for a refreshing take on crypto and prepare to be inspired! Tune in now to gain a fresh perspective on the evolving world of finance.

As we wrap up, we hope our newsletter has helped you understand the ongoing developments in the crypto market. Remember, it's important to stay informed and make smart choices as you explore the world of cryptocurrency.

Thanks for being part of our journey. Until next time, happy investing!

Zain from team inspired analyst

-Signing off!

Disclaimer: The content in this newsletter is for educational purposes only and should not be considered financial advice. Cryptocurrency trading involves risk, and past performance is not indicative of future results. Before making any financial decisions, conduct your research and consult with a qualified financial advisor. Use the content at your own discretion and risk. This is not financial advice.